Onchain analytics can help financial institutions cut through complexity

Making sense of stablecoins

INNOVATION

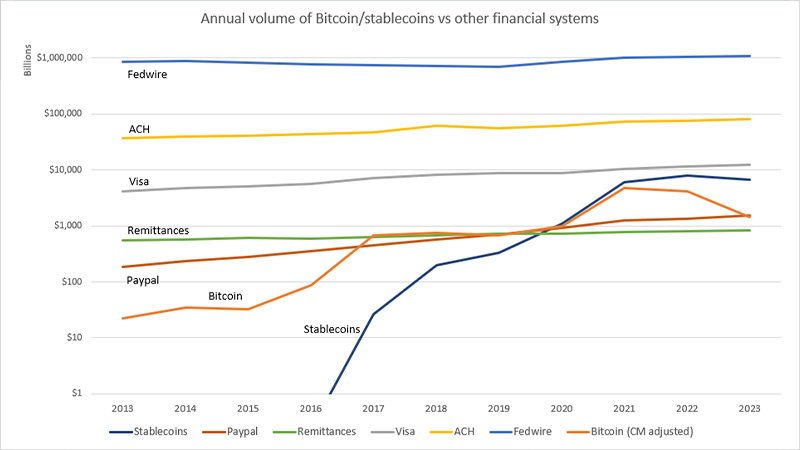

There’s a line chart that has made the rounds on social media under the headline “stable[coin]s are catching up to established settlement networks.”

It purports to show the volume that some of the world’s major settlement networks process annually, in billions of dollars, and compare those to annual stablecoin volumes. The chart shows Fedwire is way up at the top, followed by ACH, then Visa, an estimate of remittances and some other established payment platforms. All of the lines show a slow but steady rise over about 10 years’ time.

Then, there’s the stablecoin line.

The stablecoin line seems to burst onto the scene around 2016 and shoots up like a rocket in just six short years.

Taken at face value, it’s an interesting chart. But I’d argue that this comparison doesn’t really tell the full story.

Stables are catching up to established settlement network

According to the graph, in the space of 6 years, stables have gone from ~0 to near parity with Visa. (Stablecoin figures are adjusted on-chain transaction value for major stables via Coin Metrics). (Reprinted with permission, Nic Carter, Castle Island Ventures).

In stablecoin data, there is a lot of noise.

What’s unique about stablecoins compared to other payment and settlement networks is that, because they are issued and transferred over public blockchain networks, stablecoin transaction data is publicly available in real time.

However, accessing and organizing this data requires knowledge and expertise in how blockchains operate. This can be challenging, particularly when stablecoins are used across many different blockchains that each have their own nuances.

There is also a lot of noise in this data given that blockchains are general purpose networks where stablecoins can be used across a range of use cases with transactions that can be initiated manually by an end user or programmatically through bots.

For instance, developers can create automated bot programs that perform activities such as stablecoin arbitrage, liquidity provision, and market making, among others. These activities are vital for sustaining the growing decentralized finance (defi) ecosystem. However, the onchain transactions resulting from interactions with these automated programs don’t resemble settlement in the traditional sense.

We think this programmability of transactions that blockchains enable is unique, however it’s hard to compare these transactions to the kind of organic payments activity that is more likely initiated by an end consumer or business.

In this light, what does the data actually say, clearly and plainly, adjusting for inorganic activity from bots and other artificially inflationary practices?